Filter by

SubjectRequired

LanguageRequired

The language used throughout the course, in both instruction and assessments.

Learning ProductRequired

LevelRequired

DurationRequired

SkillsRequired

SubtitlesRequired

EducatorRequired

Results for "payroll tax"

Status: Free Trial

Status: Free TrialUniversity of Illinois Urbana-Champaign

Skills you'll gain: Investments, Compliance Reporting, Tax, Tax Planning, Private Equity, Investment Management, Compliance Management, Financial Regulation, Tax Laws, Real Estate, Financial Market, Regulatory Requirements, Due Diligence, Financial Services

Status: Preview

Status: PreviewUniversity of Pennsylvania

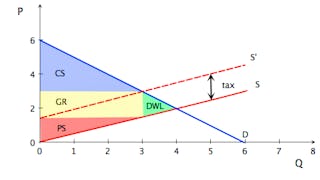

Skills you'll gain: Supply And Demand, Economics, Market Dynamics, Economic Development, Market Analysis, Resource Allocation, Policy Analysis, Tax, Consumer Behaviour, Cost Benefit Analysis, Decision Making

Status: Free Trial

Status: Free TrialUniversity of Illinois Urbana-Champaign

Skills you'll gain: Management Accounting, Operations Management, Marketing, Process Improvement, Organizational Strategy, Performance Measurement, Marketing Planning, Supply Chain, Supply Chain Management, Product Strategy, Manufacturing Operations, Operational Analysis, Business Operations, Branding, Integrated Marketing Communications, Strategic Marketing, Marketing Strategy and Techniques, Variance Analysis, Cost Accounting, Quality Control

Status: Preview

Status: PreviewWorkday

Skills you'll gain: Workday (Software), Benefits Administration, Payroll Processing, Payroll, Compensation Management, Accounts Payable and Receivable, Workforce Management, Compensation and Benefits, Recruitment

Status: Free Trial

Status: Free TrialPwC India

Skills you'll gain: Sales Tax, Tax Compliance, Tax Laws, Tax Management, Regulatory Compliance, Commercial Laws, Financial Services, Registration, Problem Solving

Status: Free Trial

Status: Free TrialUniversity of Pennsylvania

Skills you'll gain: Financial Statements, Financial Statement Analysis, Working Capital, Financial Accounting, Financial Analysis, Balance Sheet, Financial Reporting, Accounting, Inventory Accounting, Accounts Receivable, Income Tax, Tax, Equities, Cash Flows, Fixed Asset, Depreciation

Status: Preview

Status: PreviewUniversity of Florida

Skills you'll gain: Financial Planning, Risk Management, Tax Management, Financial Statements, Investments, Cash Management, Insurance, Income Tax, Financial Management, Credit Risk, Budgeting, Portfolio Management

Status: Free Trial

Status: Free TrialCoursera Instructor Network

Skills you'll gain: Payroll, HR Tech, Compensation Strategy, Generative AI Agents, Compensation and Benefits, Benefits Administration, Payroll Systems, Compensation Analysis, Compensation Management, Payroll Processing, Human Resources, Operational Efficiency, Responsible AI, Data Ethics, Workforce Management, AI Personalization, Automation, Employee Retention

Status: Preview

Status: PreviewUniversidade de São Paulo

Skills you'll gain: Intellectual Property, Labor Law, Business Modeling, Tax Planning, Regulation and Legal Compliance, Business Valuation, Labor Compliance, Law, Regulation, and Compliance, Entrepreneurial Finance, Mergers & Acquisitions, Entrepreneurship, Corporate Tax, Business Management, Financial Modeling, Compliance Management, Financial Analysis, New Business Development, Investments, Growth Strategies, Tax Laws

Status: Free Trial

Status: Free TrialSkills you'll gain: Auditing, Tax Compliance, Tax, Compliance Auditing, Tax Laws, Business Risk Management, Standard Operating Procedure, Legal Risk, Risk Mitigation, Financial Regulation, Regulatory Compliance, Law, Regulation, and Compliance, Litigation Support

Status: Preview

Status: PreviewRutgers the State University of New Jersey

Skills you'll gain: Business Planning, Risk Management, Entrepreneurial Finance, Insurance, Entrepreneurship, Cash Management, Business Strategy, Feasibility Studies, Financial Planning, Budgeting, Credit Risk, Financial Management, Investments, Loans, Intellectual Property

Status: NewStatus: Preview

Status: NewStatus: PreviewSkills you'll gain: Portfolio Management, Investment Management, Investments, Tax Planning, Wealth Management, Risk Management, Financial Planning, Asset Management, Goal Setting, Equities, Financial Analysis, Financial Acumen, Planning

Searches related to payroll tax

In summary, here are 10 of our most popular payroll tax courses

- Alternative Investments and Taxes: Cracking the Code : University of Illinois Urbana-Champaign

- Microeconomics: The Power of Markets: University of Pennsylvania

- Value Chain Management: University of Illinois Urbana-Champaign

- Workday in Action Series: Workday

- GST - Genesis and imposition!: PwC India

- More Introduction to Financial Accounting: University of Pennsylvania

- Personal & Family Financial Planning: University of Florida

- GenAI for Compensation, Benefits and Payroll: Coursera Instructor Network

- Consolidando empresas: Estrutura jurídica e financeira: Universidade de São Paulo

- GST - Audit, assessment and litigation: PwC India